How Inkjet Technology Is Transforming Book Production

Production inkjet printing systems have not been in the market that long, but they have had a huge impact. The first industry to take advantage of inkjet was the bills and statements market. Inkjet printing systems provided the means to achieve a long-desired goal of removing preprinted shells from the workflow process.

For decades, transactional printing was a two-step process: (1) preprint a form with logos and other design elements and (2) run that preprinted shell through a monochrome, toner-based printer to add variable data elements, including the customer-specific information. Once they realized they could eliminate preprinted shells, transactional printers adopted production inkjet systems in droves. This one-step process resulted in an immediate cost and workflow benefit and provided additional flexibility in using color for variable elements. Ever heard of the term “TransPromo”? It wouldn’t have entered the lexicon without production inkjet systems, which offered the required speed, productivity, reliability, and print quality.

At the same time, direct mailers and book printers were also benefiting from these advantages. Their quality standards were typically higher, but they had many applications that were a perfect fit for production inkjet printing systems. What these new markets desired was a broader selection of suitable paper stocks, particularly coated ones. Expanding the use of production inkjet systems in the book market makes this a requirement.

Challenges and Solutions

Light coverage applications printed on uncoated papers are inkjet’s sweet spot. This is why transactional printing was the first market to see the benefits of these printing systems. As coverage levels go up, inkjet printing systems must work harder to dry the amount of water-based ink put on the paper. Although this is a challenge, it’s not insurmountable. Printing system designers have created special inks and advanced drying systems and worked with paper mills to create cost-effective inkjet-treated papers. The resulting systems balance cost, quality, and speed to produce color digital print at unheard-of productivity levels. The magic is integrating the best digital print values (e.g., just-in-time production and personalized print) into inkjet systems that run productivity circles around toner-based systems while challenging traditional web offset presses.

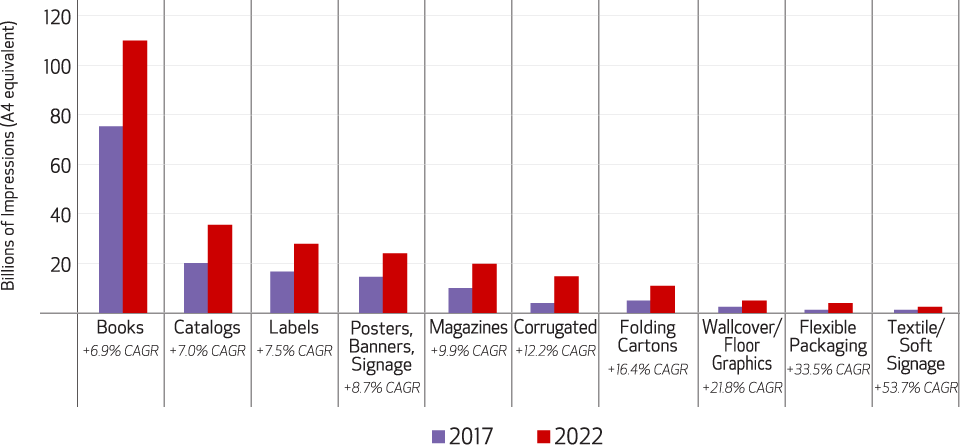

Fastest Growing Production Digital Print Applications

Source: U.S. Digital Production Printing Application Forecast 2017–2022, Keypoint Intelligence?–InfoTrends.

Growth in the Digital Printing of Books

Keypoint Intelligence–InfoTrends identified the fastest-growing production digital print applications in the United States and found the forecasted growth rate of books between 2017 and 2022 was 6.9%. Quite a few applications have higher growth rates, but as you can see in Figure 1, they are growing from a much smaller base. What is impressive about this growth prediction is that books are already a large market for production digital print, and yet there is significantly more room to grow.

Much of the early growth has been in the production of monochrome book blocks. These are really the foundation of the book industry. Many book categories do not require color but do benefit from the ability to turn backlists into ongoing revenue streams, print on-demand as orders arrive, and automate and consolidate many smaller book orders into bigger production runs. On-demand printing of books, which for many years seemed like a futuristic fantasy, is now fully operational and totally accepted by publishers at all levels. The expansion into higher quality color work on coated papers is the next step driving the growth of inkjet in production digital print.

In much the same way that inkjet enabled TransPromo in transactional markets, inkjet is now responsible for bringing on-demand book production to new heights. What’s more, trends within the book publishing industry align very well with the capabilities of inkjet.

Book Publishing Industry Trends

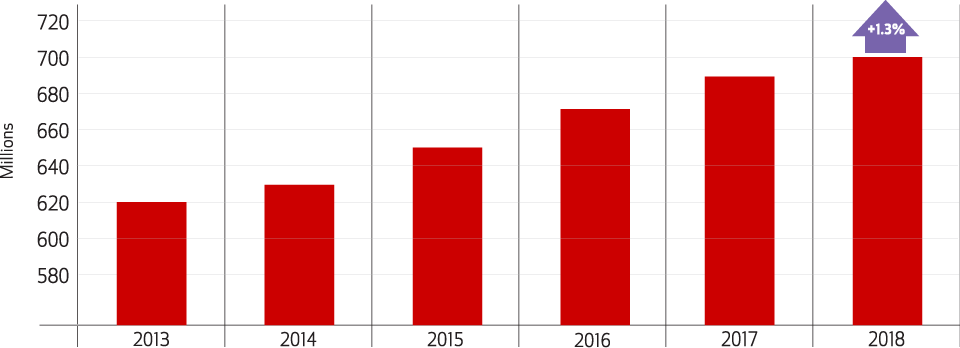

According to The NPD Group/BookScan, the U.S. printed book market grew 1.3% between 2017 and 2018. While this is not huge growth, it certainly should set to rest the dire predictions of a few years back about the death of the printed book.

More recent statistics show there was a 5% increase in U.S. print book sales from January 2019 to 2020.

Remember how people worried that e-books would eviscerate the printed book market? E-books certainly play an important role, but they have not replaced printed books. User data bears this out. Although e-books represent about $1 billion in revenue for the United States, those numbers have been steadily declining over the past few years. Part of this can be attributed to the rising interest in audiobooks, but the appeal of physical books is another key reason. NPD Group notes three out of four U.S. consumers have read a book or listened to an audiobook in the past six months.

Best-selling books are another market driver. According to NPD Group, Fifty Shades of Grey was the best-selling book of the decade, and five successful books that sold more than one million copies were behind strong book market results for 2018. (In case you were wondering, the five most successful books of 2018—in order—were Michelle Obama’s Becoming; Magnolia Table by Joanna Gaines; Girl, Wash Your Face by Rachel Hollis; Diary of a Wimpy Kid #13 by Jeff Kinney; and Fire and Fury by Michael Wolff.) Only two titles sold more than one million copies in 2017. Now it is true that most book printers won’t have access to the best-selling books, but the trends driving success in printed books still apply to other book categories.

Further research from the NPD Group reveals love and marriage, manga, and self-help books are driving market growth. In case you aren’t familiar with manga, it’s a Japanese-inspired genre of comic books and graphic novels that appeal to adults as well as children. Manga titles are visually rich and often printed in color. Today’s consumers may no longer be satisfied with monochrome-only book blocks. Inkjet provides the key to bringing color print to targeted applications in an automated fashion. It also allows for more flexible use of color, which can be important for educational and other texts requiring highlight or process color.

The Bottom Line: Actions to Take

Now that you understand what’s driving growth in the book production market, what should you do next? Keep the following in mind:

- Focus: Given the range of book printing opportunities, it makes sense to focus on a limited number of substrates, trim sizes, and finishing methods. Finishing can be a barrier to entry for some since the number of binding types requested can range from punched pages and mechanical plastic coil or wire bindings to the case bindings and dust jackets of trade books. Outsourcing is, of course, an option for more complex bindings, but that adds time and cost to what should be an automated process.

- Promote the value of digital print: You may find there is too heavy a focus from customers—and perhaps even your own sales force—about cost comparisons of inkjet versus offset. Customers who just want the cheapest price per book are overlooking the true value of digital print, which lies in its ability to stock inventory as needed, sell only when orders are in-house, and produce content on applications not feasible with traditional offset (e.g., driving revenue from out-of-print titles).

- Pay attention to automation: When preparing to produce short runs and small batches, a print service provider must pay attention to functions that support print room activities, including job onboarding, preflighting, queuing, and support for e-commerce transactions. These capabilities are central to creating a highly automated production environment.

- Don’t overlook customers who aren’t traditional book publishers: Other book-like bound documents such as annual reports, catalogs, directories, and magazines can be attractive revenue sources.

WATCH THE VIDEO